Setting up a business in France could be a great opportunity for your company. Business Solutions Atlantic France can provide you with high-quality, free, and confidential support to make the move and get your business off the ground!

Why France is one of the best places to set up your business

France is an attractive market for starting or expanding a company and is Europe’s #1 business destination. The country has a population of over 68 million people, and the French consumer market is a sophisticated and discerning market, with a focus on high-quality products, service, and brand loyalty.

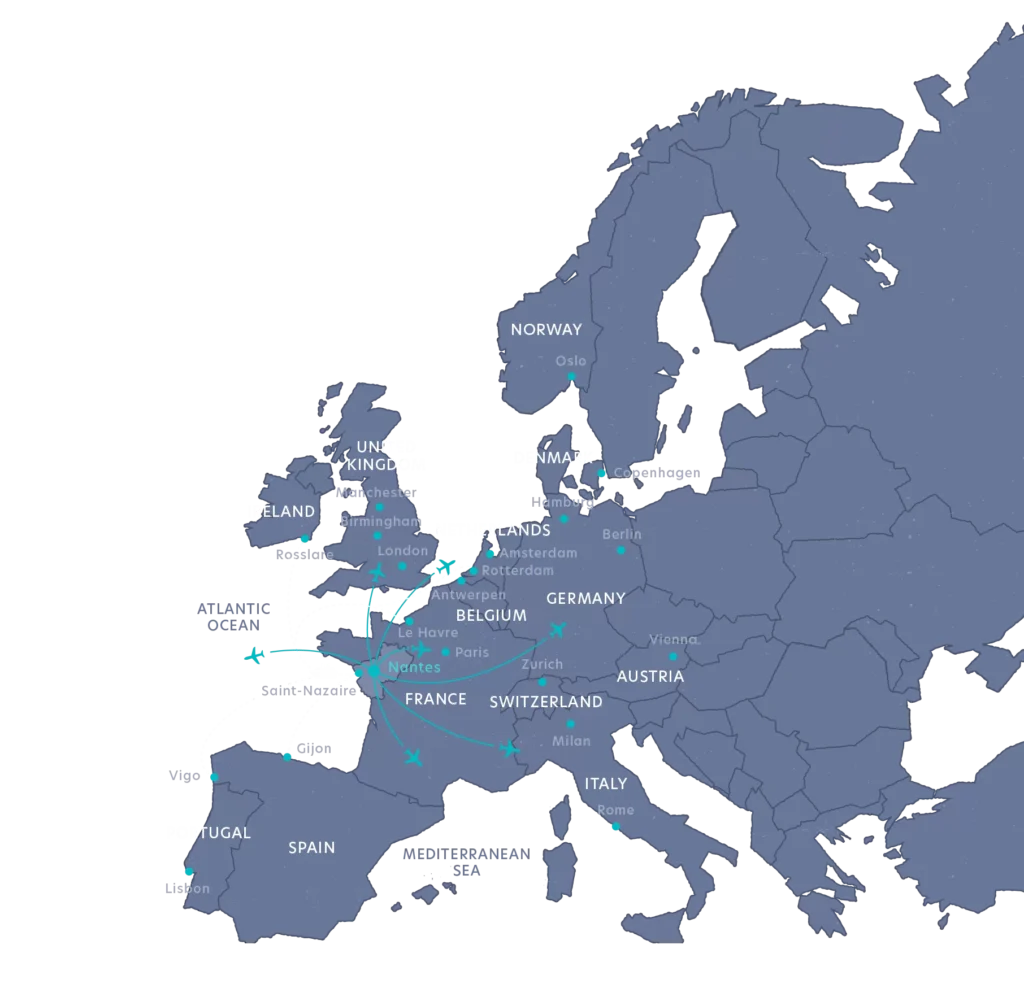

France has a well-developed transport network (motorways, railways, ports and airports) and telecommunications infrastructure, and as a member of the European Union, it offers your business access to a large market of over 500 million consumers. The country is strategically located in the heart of Europe, making it an ideal location for businesses that want to expand to several countries.

In 2021, France came second in Europe for the highest number of patents filed, and its highly skilled workforce would give you access to a talented pool of potential employees for your business. With a GDP of over €2 trillion, the country is the 6th largest economy in the world and the 4th most dynamic economy in the OECD area. Additionally, France is a popular tourist destination and its well-established legal system can provide a good level of protection for your business.

Thanks to these assets, France has been the most attractive business destination in Europe for three years in a row: 1 in 5 investment projects in Europe is located in France, according to an EY survey taken in 2022.

The key steps for launching an enterprise in France

Starting a business in France is not complicated and administrative formalities for the establishment of international companies have been greatly reduced in recent years: setting up a business only takes 3.5 days in France – compared to 4.5 in the UK and 10.5 in Germany.

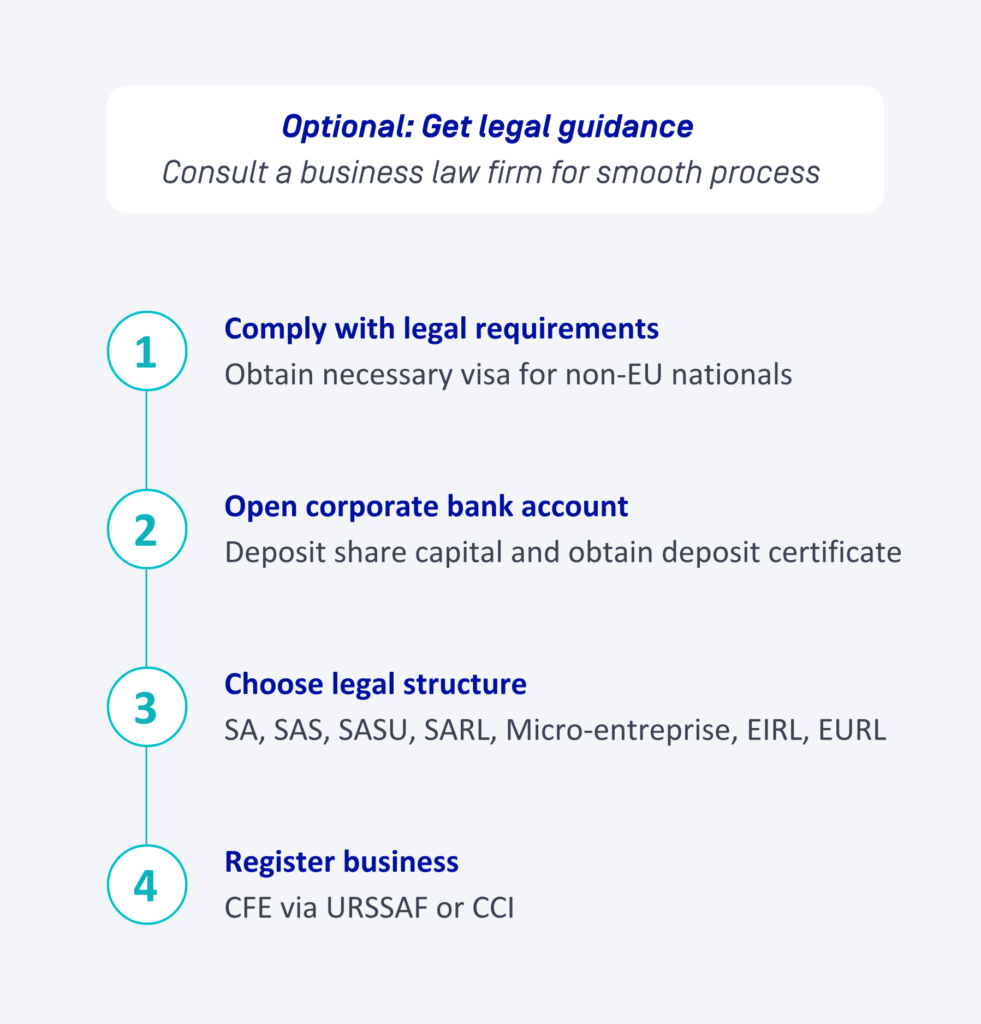

Nevertheless, certain steps must be taken to avoid your time being wasted or issues arising later on. We therefore strongly recommend that you be accompanied by a legal firm specialised in business law to provide you with legal advice, in order for your installation process in France to be carried out as smoothly as possible.

Do you need an entrepreneur’s guide? Here is our step-by-step guidance for business registration:

1. Comply with the legal requirements for launching a company in France

Starting a business in France is an exciting opportunity, but the requirements vary depending on your country of origin. For non-European Union or non-Schengen nationals, obtaining a business visa is a crucial step. This visa, known as a “long-stay visa for entrepreneurs” (visa de long séjour valant titre de séjour – entrepreneur/profession libérale), is mandatory for setting up an enterprise. UK and US citizens, for instance, require this long-stay visa to legally establish and manage a business in France.

2. Open a corporate bank account

Opening a corporate bank account is a critical step in establishing your business in France. You must deposit the company’s share capital into a frozen account specifically set up for this purpose. Once the deposit is made, the bank will provide a deposit certificate. This certificate, a mandatory document for signing the company’s articles of association, serves as proof that the share capital is secured. This ensures your business complies with French legal and financial requirements from the outset.

3. Choose the right legal structure

Understanding the different types of businesses in France is essential. Below is a quick overview:

- SA (Société anonyme): equivalent to the “Public Limited Company (PLC) in the United Kingdom and similar to the “C Corporation” in the USA.

- SAS (Société par actions simplifiée): similar to the SA, a flexible structure favoured by many businesses due to its simplicity in formation and operational management.

- SASU (Société par actions simplifiée unipersonnelle): allows a single shareholder, whether a natural or legal person, to operate a business with limited liability.

- SARL (Société à Responsabilité Limitée): suitable for small and medium-sized businesses with multiple partners, offering limited liability similar to the SASU.

- Micro-entreprise: ideal for small businesses and freelancers, this structure is popular among entrepreneurs looking to streamline business administration.

- EIRL (Entrepreneur Individuel à Responsabilité Limitée) and EURL (Entreprise Unipersonnelle à Responsabilité Limitée): allow an individual to operate as a sole entrepreneur while separating personal assets from those dedicated to professional activity.

Choose the right business category

4. Register your business

You will have to register your business with the French government via the CFE, Centre de Formalités des Entreprises (Business Formalities Centre), which is run by the URSSAF, the organisation that manages the social security system for businesses in France. The CCI, Chambre de Commerce et d’Industrie (Chamber of Commerce and Industry), or the legal firm you chose to support you, will provide you with information and guidance on the different legal structures, taxes, and regulations that apply to your business.

Financing options for a business in France

In addition to traditional bank loans and other financing schemes such as crowdfunding, entrepreneurs in France can have access to government-backed loan programs and supportive policies.

Businesses can obtain subsidies from the French Government, in particular through the €100 billion “France 2030” investment plan, and dedicated national or regional subsidies which support innovation.

France also offers a wide range of tax incentives for international companies, low-interest or zero-interest loans, and financial support such as co-financing, financial guarantees and capital injection.

Finding the right talent for your business

Here are a few key things to keep in mind when recruiting in France:

- France has labour laws and regulations that protect both employers and employees; these include minimum wage requirements, overtime pay, vacation time, and other benefits. Employers must also provide safe working conditions and comply with anti-discrimination laws.

- France offers excellent flexibility for businesses that are hiring and firing employees. Companies can negotiate wages and conditions directly with employees and can benefit from a 2 to 8 month trial period for new hires.

- France has a highly educated and skilled workforce, and there are a variety of ways to find the right talent for your business, such as job fairs, networking events, online job boards and recruitment agencies. Additionally, many universities and trade schools have career centres that can help connect employers with recent graduates. In Atlantic France, we developed a web platform to help companies recruit: https://nosemplois.fr.

- Once you have hired employees, you will need to set up a payroll system. This includes registering with the French social security system, which is responsible for collecting and managing employee contributions and determining the appropriate taxes that should be withheld from employee paychecks.

Ready to make the move? We are here to help!

Starting a business in France can be a challenging and exciting experience. It’s a great opportunity to be part of such a vibrant and dynamic business environment.

If you are unfamiliar with the French business environment, it can be very helpful to rely on a business advisor who will guide you through the process of setting up and running a business in France.

Unlock your business potential in France – contact our experts for free, confidential advice today.

Other useful resources for starting a business in France

- The Business France and Invest in France websites. Business France is the national agency that helps foreign companies to develop their business in France and Business Solutions Atlantic France is its official partner for the Atlantic France region (Pays de la Loire).

- The guide Doing Business in France, produced by Business France in partnership with the leading accountancy firm Deloitte.

- The document Inclusive Entrepreneurship Policies: Country Assessment Notes – France, 2018, published by the OECD (Organisation for Economic Co-operation and Development).

Need more details about setting up a business in France? Explore our other pages for more in-depth information!

> Essential business regulation guidelines in France

> Comprehensive guide to business categories in France for entrepreneurs

> Starting a business in France as a foreigner: a comprehensive guide

> Dos and don’ts: mastering business etiquette in France

日本語

日本語  Français

Français